| Buy & Hold | SPW | |

|---|---|---|

| PNL | 5,229 | 5,148 |

| OK | n/a | 91.7% |

| DrDwn | 18.9% | 16.0% |

| Cagr | 1844.2 | 1818.8 |

Closed Ops: 12 – Won: 11 Lost: 1

Profit Ratio: 7274%

System Quality Number: 3.3

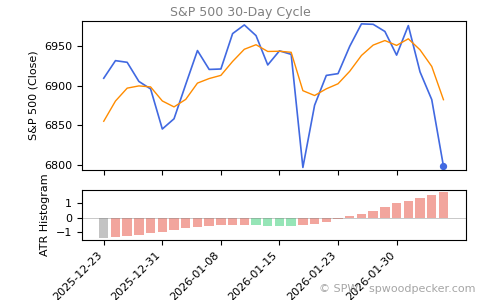

Performance Summary: SPW Strategy vs. Buy & Hold

SPW, our S&P500 Trading System continues to provide a high return rate of 1818.8%, with less drawdown than a Buy & Hold approach: 16.0 SPW vs. 18.9 Buy & Hold. It currently maintains a win rate of 91.7, with 11 wins and only 1 losses.

Volatility Analysis

Volatility wave is currently in phase 1 — Downthrust Phase.

As of February 05, 2026, SPX fell -1.23%. The market is on the higher region of the volatility wave, reflecting an extended rally, and short-term swings are intensifying.

© SPW · spwoodpecker.com

Leave a Reply